Guido Mantega, Brazil’s powerful finance minister, said this week that global economic growth will slow in 2012, leading to an intensification of the destructive “currency war”.

Does this mean that we may see more government intervention in the Brazilian exchange rate, or simply that Brazil has not tired of dishing out acerbic critiques of the US and Europe?

Mantega famously coined the term, “currency war”, in late 2010 to describe a change after the 2008 crisis, in which countries were fighting to weaken their currencies against each other. Since of course this is not possible for everyone, international cooperation breaks down and ominously, countries end up battling each other with policy instruments.

Basically, he was talking about the following:

After the crisis tore through the rich countries in 2008, they slashed their interest rates to zero, passed large stimulus packages, and then ended up turning to quantitative easing – essentially printing money – in an attempt to further boost the economy.

The flip-side of this is that a large amount of the capital previously invested in those countries was moved to countries like Brazil, where there was essentially no crisis, and rates of growth and interest were much higher. These huge inflows caused the Brazilian real to appreciate greatly, causing many to worry that the high cost of Brazilian exports would kill off manufacturing, or “de-industrialize” the country.

Mantega has been especially critical of quantitative easing in the US.

“It’s no use throwing dollars out of a helicopter,” he said in late 2010. “The only result is to devalue the dollar to achieve greater competitiveness on international markets.”

Brazil retaliated by intervening in currency markets and introducing a set of capital controls, making it more difficult and expensive to move money in and out of the country, putatively slowing down appreciation while certainly infuriating many international investors.

But since then the situation has complicated. Mantega made his recent remarks, the Wall Street Journal reported, at a meeting of finance ministers in Mexico City. These days, worries about the potential collapse of Europe are more predominant than currency concerns. The effect of that crisis has largely been to bring the Brazilian real back down somewhat, as global panic usually means a flow of investment into safe currencies like the dollar.

Mantega is no doubt right that this year could be a rocky one for the global economy. That this could lead to more effective devaluations in the US and Europe is quite possible, which could surely lead people like Mantega to take counter-actions.

Let’s hope he was warning against the possibility of intensification, rather than accurately predicting the future. Historically, competitive devaluations have not served us well.

Links

LA Times: worries about “de-industrialization”

Wikipedia – A surprisingly hefty entry built around Mantega

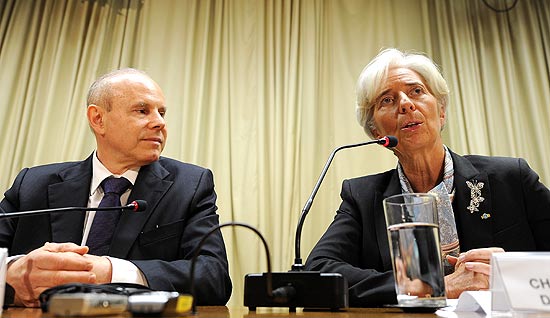

Photo above – Mantega with IMF Chief Christine Lagarde